How to Become a Successful Day time Trader Using Tested Strategies, Tools, in addition to Psychology

Long gone are usually the days any time only Wall Street specialists could trade the particular markets. Thanks to be able to modern platforms in addition to online education, anyone can easily learn how to become a successful day trader using proven strategies. Even so, mastering the art requires more compared to just placing randomly trades—it takes technical skill, discipline, the right tools, and mental control. In this guide, you'll learn: What must be done to turn into a profitable day time trader Best approaches for beginner day dealers How to handle risk while day trading stocks and even crypto  Top equipment and indicators applied by successful day time traders Day investing psychology tips to be able to avoid emotional selections How to pick the proper day buying and selling platform for your requirements Whether you're trading from your laptop in the home or looking to be able to scale into full-time trading, this write-up is designed to allow you to build your current foundation. 🔍 Precisely what Does It Consider to Become some sort of Profitable Day Investor? A profitable working day trader consistently makes gains by exploiting small price motions in high-volume stores. But what sets them apart is not just knowledge—it’s how they apply that knowledge with speed, accuracy, and emotional control. To turn out to be a successful working day trader, you require: A clear day trading strategy that meets your risk patience The ability in order to read and interpret technical chart

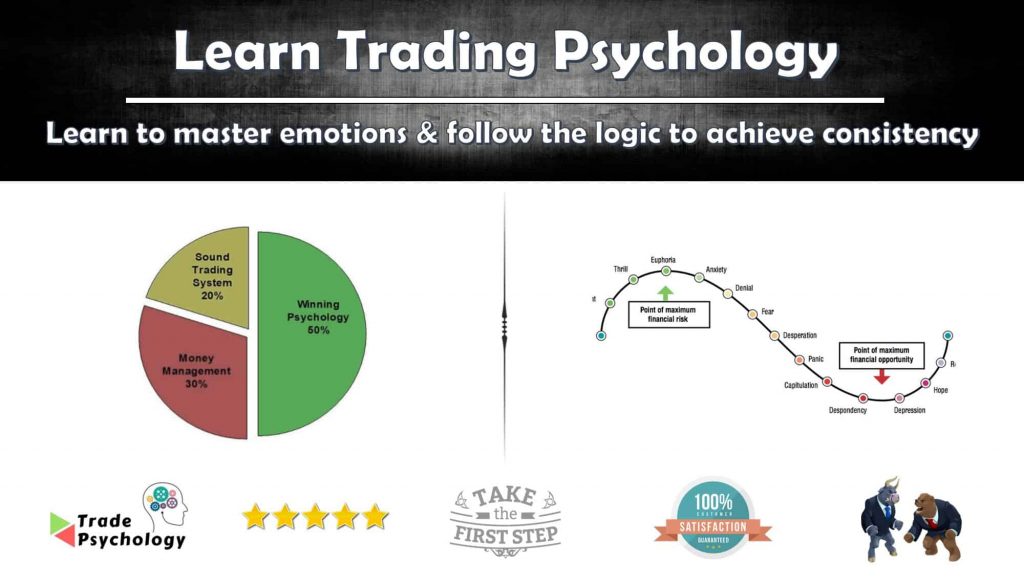

Top equipment and indicators applied by successful day time traders Day investing psychology tips to be able to avoid emotional selections How to pick the proper day buying and selling platform for your requirements Whether you're trading from your laptop in the home or looking to be able to scale into full-time trading, this write-up is designed to allow you to build your current foundation. 🔍 Precisely what Does It Consider to Become some sort of Profitable Day Investor? A profitable working day trader consistently makes gains by exploiting small price motions in high-volume stores. But what sets them apart is not just knowledge—it’s how they apply that knowledge with speed, accuracy, and emotional control. To turn out to be a successful working day trader, you require: A clear day trading strategy that meets your risk patience The ability in order to read and interpret technical chart  Rapid execution plus the appropriate trading platform Everyday commitment to learning, backtesting, and improving Many new dealers ask: how long does it take to become a consistently profitable day trader? The particular answer varies, nevertheless most traders carry 6 months to be able to a couple of years of regular practice. ⚙️ Best Approaches for Beginner Day Investors If you’re wondering what are the best strategies for beginner day traders, in this article are three tested methods which can be great for learning: a single. Breakout Trading Technique for Day Traders This plan involves identifying essential price levels (support/resistance) and entering trades if the price “breaks out” of these kinds of zones. Tools: VWAP, volume indicators, candlestick patterns Perfect for: Unpredictable stocks, crypto, and even small-cap stocks and options 2. Momentum Trading Method for Intraday Income In momentum stock investing, you focus in high-volume stocks shifting due to news or earnings. You ride the momentum, aiming to exit ahead of the reversal. Tools: RSI, MACD, news scanners Timeframe: 1- to 5-minute charts 3. Reversal Trading Strategy for A lot more Experienced Day Traders This is riskier but effective whenever mastered. You seem for overbought or oversold signals to be able to trade in the opposite direction regarding the current shift. Tools: Bollinger Artists, Stochastic Oscillator, RSI Ideal for: Sluggish, range-bound markets By simply wondering which day trading strategy works best for my personality, a person can start filtering out tactics that don’t suit your current trading style. 📊 Top Tools and Indicators Used by simply Day Investors Good results in daytrading usually depends on just how well you make use of your tools. Under are essential tools used in extremely successful day stock trading setups. ✅ Stock trading Platforms: Webull – Ideal for U. S. stocks, free of charge Level 2 info, and advanced chart TradingView – Finest for multi-asset charting and strategy backtesting ThinkorSwim by TD Ameritrade – Great for options and custom indicators The program and 5 – Standard for fx traders If you’re searching for the best trading platform for day trading beginners, Webull and TradingView are quite recommended. ✅ Complex Indicators: VWAP (Volume Weighted Average Price) – Measures fair value; used for entries/exits MACD (Moving Average Convergence Divergence) – Identifies trend shifts RSI (Relative Strength Index) – Spots overbought/oversold regions Fibonacci Retracement – Pinpoints support and resistance zones In case you're new, start out by learning to make use of RSI and MACD to day buy and sell stocks—they're beginner-friendly and widely trusted. 💼 Risk Management Tactics for Day Trading Not any amount of ability will save a person in case you ignore risk management. One of the leading questions new traders question is: how to manage risk effectively while day trading? In this article are key principles: 1. Use Stop-Loss Orders Every Time You Enter a new Trade Protect your current capital by environment a max reduction level per industry. The 1% concept is a classic—never risk more compared to 1% of your account on one buy and sell. 2. Utilize how to use RSI and MACD to day trade stocks Sizing Formula To avoid psychological decisions, base each trade on mathmatical. Tools like position size calculators for day traders are invaluable. a few. Avoid Revenge Stock trading and Overtrading Having impulsive trades to recoup losses usually ends in more losses. Retain a daily hat within the number involving trades or risk. Learning how to control losses while day trading is often more significant than how to be able to win. 🧠 Typically the Role of Mindsets in Day Trading Good results Why do many beginner traders are unsuccessful? The answer normally boils down to be able to psychology. In spite of the solid strategy, feelings like fear, avarice, and FOMO (Fear of Missing Out) can ruin your own results. Top day trading investing psychology tips incorporate: Have an usual. Adhere to a period slot, strategy, and even process. Prevent the reports feed once you're in a buy and sell. It’ll only discompose you. Keep some sort of trading journal. Overview what you performed correct or incorrect daily. Get breaks. Stepping apart after losses inhibits emotional trading. When you’ve ever considered how to stay disciplined as a day trader, understand of which success is 80% mindset, 20% method. 💻 Selecting the most appropriate Investing Platform for Your Needs There’s simply no universal “best” platform. Your choice depends on: Your trading market (stocks, options, foreign exchange, crypto) Your location (U. S. -based or international) The experience level No matter if you need mobile or perhaps desktop tools In case you're looking intended for the best free day trading application for newbies, Webull and even TradingView are exceptional. If you plan to automate methods, platforms like NinjaTrader or MetaTrader a few are better matched. ❓ Frequently Inquired Questions Can My partner and i learn day buying and selling without an advisor? Yes—but it usually takes longer. There are usually thousands of cost-free and paid sources available. Just guarantee you're following genuine educational platforms intended for day trading. How much capital carry out I need to be able to start day trading investing? Along with a margin account, you’ll need at least $25, 000 to stop PDT restrictions (in the U. T. ). If using a cash account, you can begin with as little as $500–$1, 1000. Is day trading investing successful in 2025? Absolutely—but only for investors with a well-tested strategy, proper risk controls, and on-going education. 🧠 Last Thoughts: How to be some sort of Successful Trader inside of 2025 and Further than The path in order to becoming a successful day time trader is not really linear. You will have loss, frustrations, and base. But if you're committed to understanding how to day trade using the particular right tools in addition to strategies, it’s totally possible to develop the skillset that produces income. ✅ Crucial Takeaways: Figure out how to day time trade stocks making use of technical analysis Pick a platform that matches your needs plus budget Backtest your current strategy and record every business Concentrate on risk managing in day trading above all else Practice mindfulness plus emotional control The best traders inside the world didn’t make it happen overnight. That they devoted to showing upward every day, researching their trades, and adapting to altering markets. So, in the event that you’re still thinking how to turn into a profitable day time trader with persistence, the answer will be simple: education, self-control, and time.

Rapid execution plus the appropriate trading platform Everyday commitment to learning, backtesting, and improving Many new dealers ask: how long does it take to become a consistently profitable day trader? The particular answer varies, nevertheless most traders carry 6 months to be able to a couple of years of regular practice. ⚙️ Best Approaches for Beginner Day Investors If you’re wondering what are the best strategies for beginner day traders, in this article are three tested methods which can be great for learning: a single. Breakout Trading Technique for Day Traders This plan involves identifying essential price levels (support/resistance) and entering trades if the price “breaks out” of these kinds of zones. Tools: VWAP, volume indicators, candlestick patterns Perfect for: Unpredictable stocks, crypto, and even small-cap stocks and options 2. Momentum Trading Method for Intraday Income In momentum stock investing, you focus in high-volume stocks shifting due to news or earnings. You ride the momentum, aiming to exit ahead of the reversal. Tools: RSI, MACD, news scanners Timeframe: 1- to 5-minute charts 3. Reversal Trading Strategy for A lot more Experienced Day Traders This is riskier but effective whenever mastered. You seem for overbought or oversold signals to be able to trade in the opposite direction regarding the current shift. Tools: Bollinger Artists, Stochastic Oscillator, RSI Ideal for: Sluggish, range-bound markets By simply wondering which day trading strategy works best for my personality, a person can start filtering out tactics that don’t suit your current trading style. 📊 Top Tools and Indicators Used by simply Day Investors Good results in daytrading usually depends on just how well you make use of your tools. Under are essential tools used in extremely successful day stock trading setups. ✅ Stock trading Platforms: Webull – Ideal for U. S. stocks, free of charge Level 2 info, and advanced chart TradingView – Finest for multi-asset charting and strategy backtesting ThinkorSwim by TD Ameritrade – Great for options and custom indicators The program and 5 – Standard for fx traders If you’re searching for the best trading platform for day trading beginners, Webull and TradingView are quite recommended. ✅ Complex Indicators: VWAP (Volume Weighted Average Price) – Measures fair value; used for entries/exits MACD (Moving Average Convergence Divergence) – Identifies trend shifts RSI (Relative Strength Index) – Spots overbought/oversold regions Fibonacci Retracement – Pinpoints support and resistance zones In case you're new, start out by learning to make use of RSI and MACD to day buy and sell stocks—they're beginner-friendly and widely trusted. 💼 Risk Management Tactics for Day Trading Not any amount of ability will save a person in case you ignore risk management. One of the leading questions new traders question is: how to manage risk effectively while day trading? In this article are key principles: 1. Use Stop-Loss Orders Every Time You Enter a new Trade Protect your current capital by environment a max reduction level per industry. The 1% concept is a classic—never risk more compared to 1% of your account on one buy and sell. 2. Utilize how to use RSI and MACD to day trade stocks Sizing Formula To avoid psychological decisions, base each trade on mathmatical. Tools like position size calculators for day traders are invaluable. a few. Avoid Revenge Stock trading and Overtrading Having impulsive trades to recoup losses usually ends in more losses. Retain a daily hat within the number involving trades or risk. Learning how to control losses while day trading is often more significant than how to be able to win. 🧠 Typically the Role of Mindsets in Day Trading Good results Why do many beginner traders are unsuccessful? The answer normally boils down to be able to psychology. In spite of the solid strategy, feelings like fear, avarice, and FOMO (Fear of Missing Out) can ruin your own results. Top day trading investing psychology tips incorporate: Have an usual. Adhere to a period slot, strategy, and even process. Prevent the reports feed once you're in a buy and sell. It’ll only discompose you. Keep some sort of trading journal. Overview what you performed correct or incorrect daily. Get breaks. Stepping apart after losses inhibits emotional trading. When you’ve ever considered how to stay disciplined as a day trader, understand of which success is 80% mindset, 20% method. 💻 Selecting the most appropriate Investing Platform for Your Needs There’s simply no universal “best” platform. Your choice depends on: Your trading market (stocks, options, foreign exchange, crypto) Your location (U. S. -based or international) The experience level No matter if you need mobile or perhaps desktop tools In case you're looking intended for the best free day trading application for newbies, Webull and even TradingView are exceptional. If you plan to automate methods, platforms like NinjaTrader or MetaTrader a few are better matched. ❓ Frequently Inquired Questions Can My partner and i learn day buying and selling without an advisor? Yes—but it usually takes longer. There are usually thousands of cost-free and paid sources available. Just guarantee you're following genuine educational platforms intended for day trading. How much capital carry out I need to be able to start day trading investing? Along with a margin account, you’ll need at least $25, 000 to stop PDT restrictions (in the U. T. ). If using a cash account, you can begin with as little as $500–$1, 1000. Is day trading investing successful in 2025? Absolutely—but only for investors with a well-tested strategy, proper risk controls, and on-going education. 🧠 Last Thoughts: How to be some sort of Successful Trader inside of 2025 and Further than The path in order to becoming a successful day time trader is not really linear. You will have loss, frustrations, and base. But if you're committed to understanding how to day trade using the particular right tools in addition to strategies, it’s totally possible to develop the skillset that produces income. ✅ Crucial Takeaways: Figure out how to day time trade stocks making use of technical analysis Pick a platform that matches your needs plus budget Backtest your current strategy and record every business Concentrate on risk managing in day trading above all else Practice mindfulness plus emotional control The best traders inside the world didn’t make it happen overnight. That they devoted to showing upward every day, researching their trades, and adapting to altering markets. So, in the event that you’re still thinking how to turn into a profitable day time trader with persistence, the answer will be simple: education, self-control, and time.